rsu tax rate us

At what rate are RSUs taxed when they are awardedvest. 1 At the time of vesting and 2 At the time of sale.

Rsu Taxes Explained 4 Tax Strategies For 2022

How Are Restricted Stock Units RSUs Taxed.

. In order to make employee compensation more manageable for tech companies at least a portion of it can be paid in the form. For academic purposes. Short-term capital gains tax ordinary income tax rates otherwise this includes immediate sale caution When you receive your shares you are taxed on.

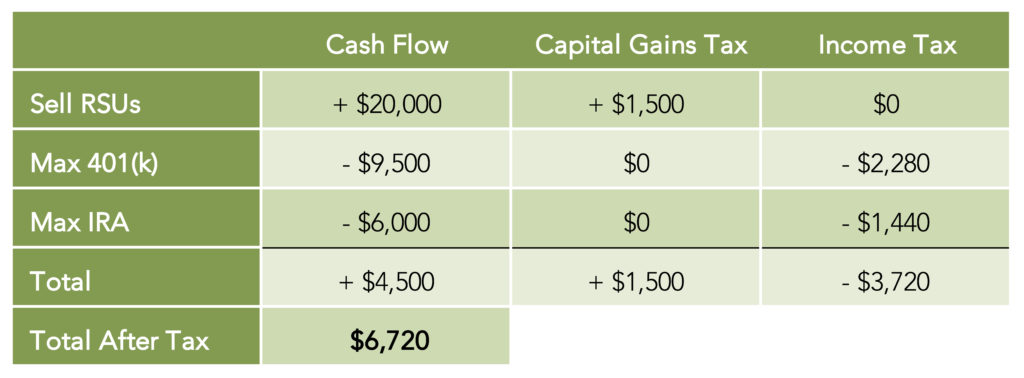

Heres the tax summary for RSUs. Generally there is no tax upon the sale of shares if the shareholder together with their fiscal partner has an interest less than 5 percent in the nominal subscribed share capital determined per class of shares. A single filer who earns 150k of.

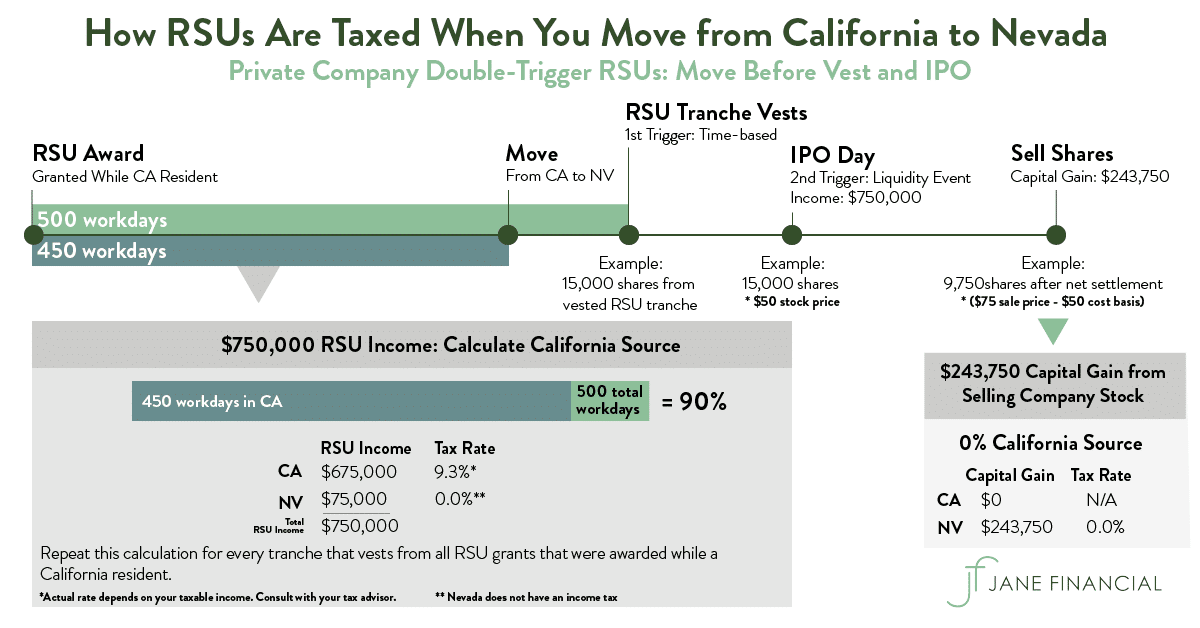

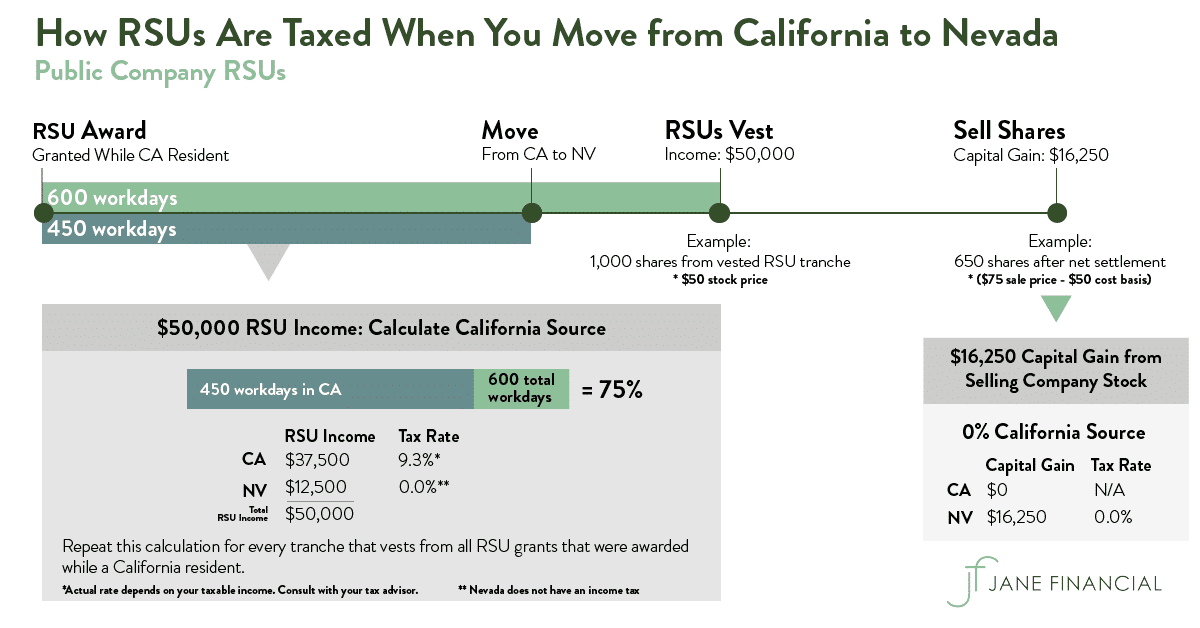

RSUs are taxed as W-2 income subject to federal and employment tax Social Security and Medicare and any state and local tax. Vesting after making over 200k single 250k jointly. RSUs are taxed upon the delivery of shares which is generally upon vesting as income from employment at the progressive tax rate up to 495 percent.

And then immediately lost 12 ending up closing the first day of trading at 34. The stock is restricted because it is subject to certain conditions. The timing of RSU tax is exactly the same as any other.

Is it just income tax rate or cap gains. Will I get a refund laterIs there a way to avoid this. Ad Thinking of switching from stock options to RSUs restricted stock options.

Vesting after Medicare Surtax max. Many employees receive restricted stock units RSUs as a part of their compensation particularly in the tech industry. Marginal is the rate you pay on the next dollar of earned income whereas effective tax rate is the average rate you pay on every dollar of income.

Robinhood just went IPO on July 28. Ordinary tax on current share value. This rate is 238 20 plus the 38 tax on net investment income for high-earning taxpayers.

Conversely when a restricted stock unit is. Vesting after Social Security max. Unlike the much more complicated ESPP they get taxed the same way as your income.

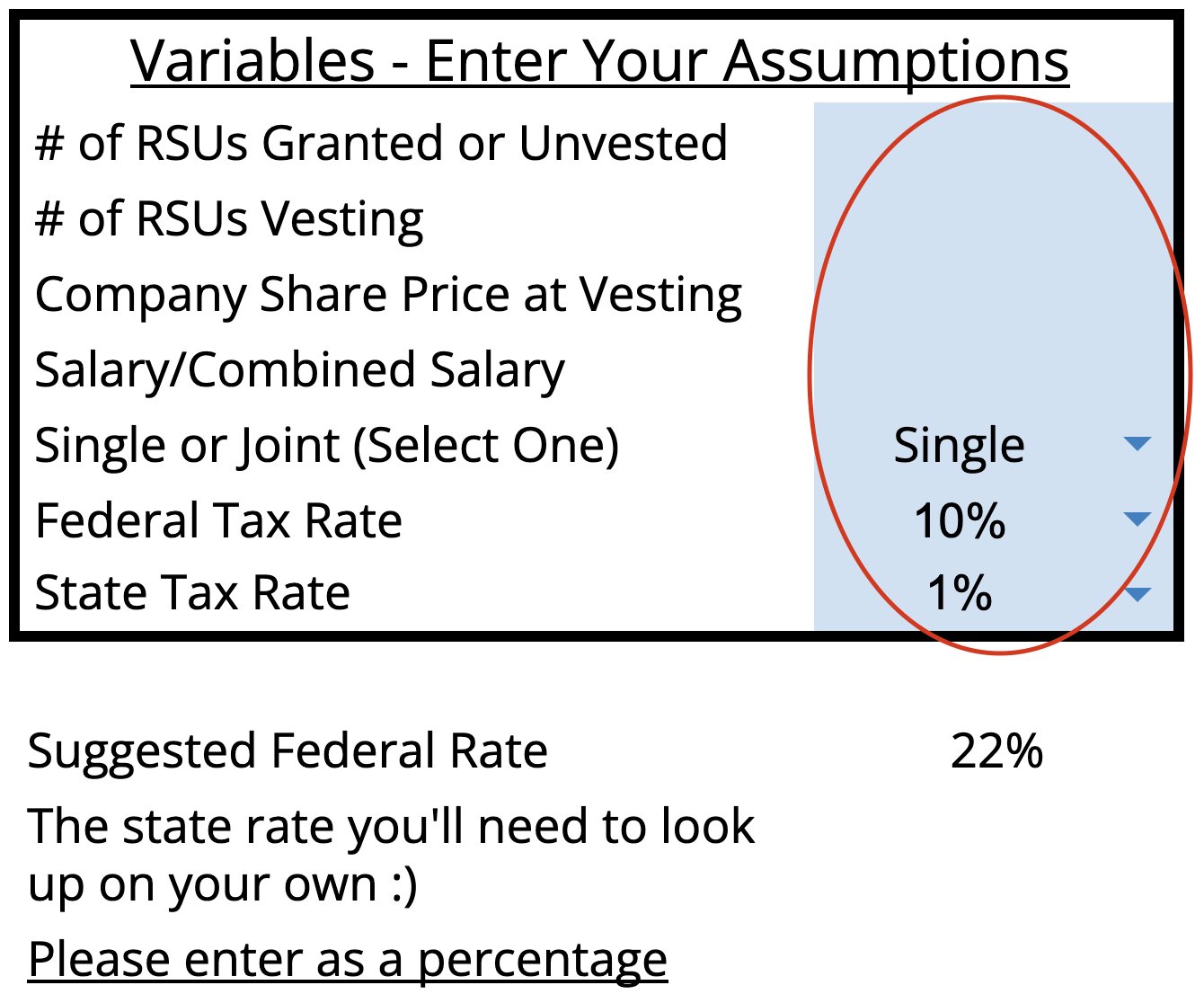

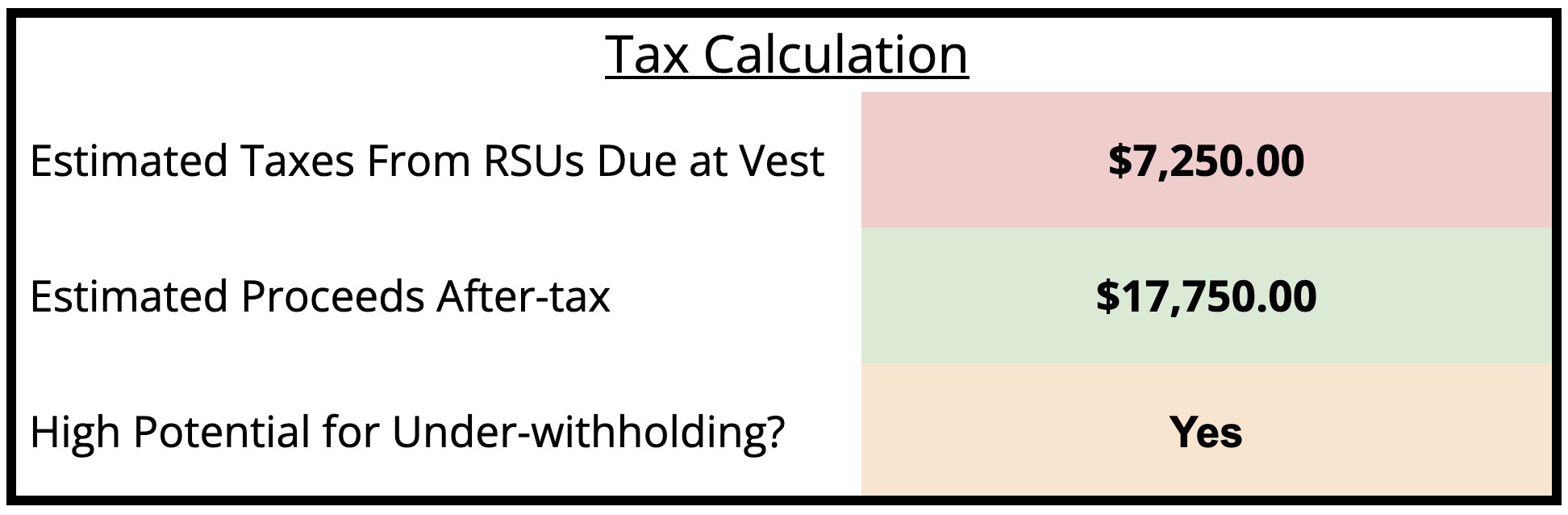

Most employers will withhold taxes on your RSUs at a rate of 22 but you could easily be in a higher tax bracket than that. At the time of vesting. RSU Taxes - A tech employees guide to tax on restricted stock units.

My rsu is distributed with higher tax rate than my actual effective tax rate. Vesting after making over 137700. When the Restricted Stock Unit is considered eligible deferred compensation there is no deemed distribution at exit and a 30 tax is withheld at the time payments are made.

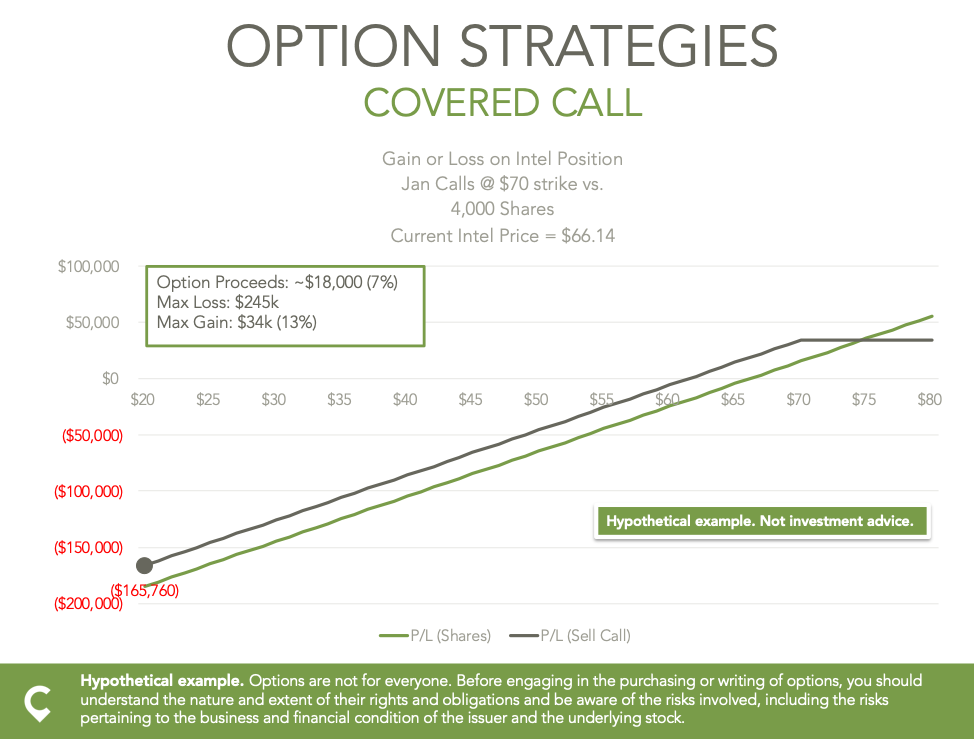

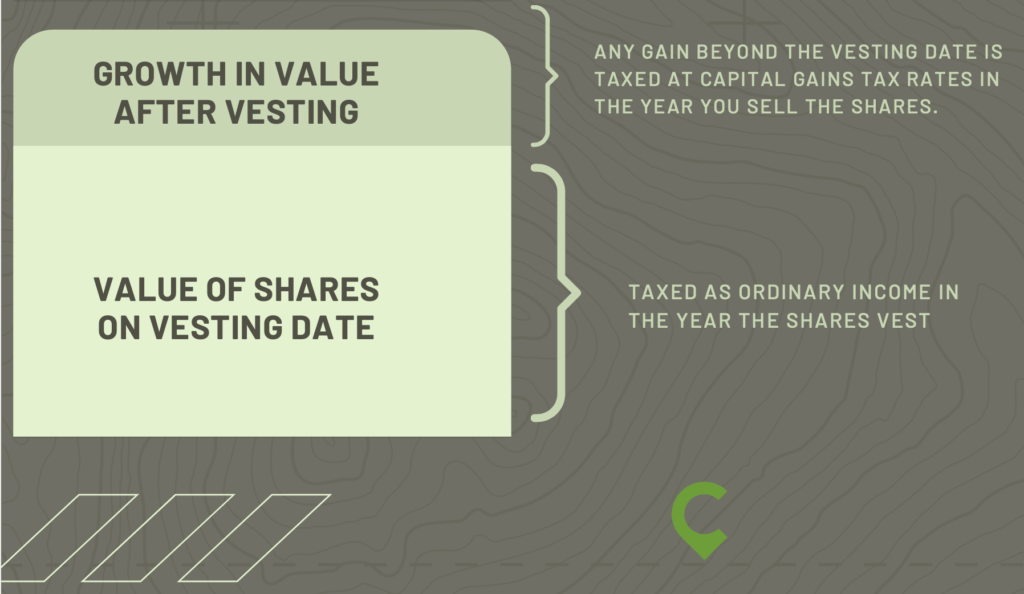

Plan For the RSU Vesting Event Once youve used the RSU tax calculator to determine your estimated taxes and estimated proceeds youll want to make a plan so you know what you want to do with your company shares after the vesting date. Long-term capital gains tax on gain if held for 1 year past vesting. For one a recipient cannot sell or otherwise transfer ownership of the stock to another person until the restrictions lift.

RSUs can also be subject to capital. This happens over time through a vesting schedule. The price could have fallen from the IPO list price.

Restricted stock is a stock typically given to an executive of a company. Here is an article on employee stock options. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer.

The beauty of RSUs is in the simplicity of the way they get taxed. The US uses a progressive tax system so its important to be aware of the difference between what your highest marginal income tax rate is and what your effective tax rate is. The companies many a times sell certain portion of such shares after vesting to pay the tax on such vesting.

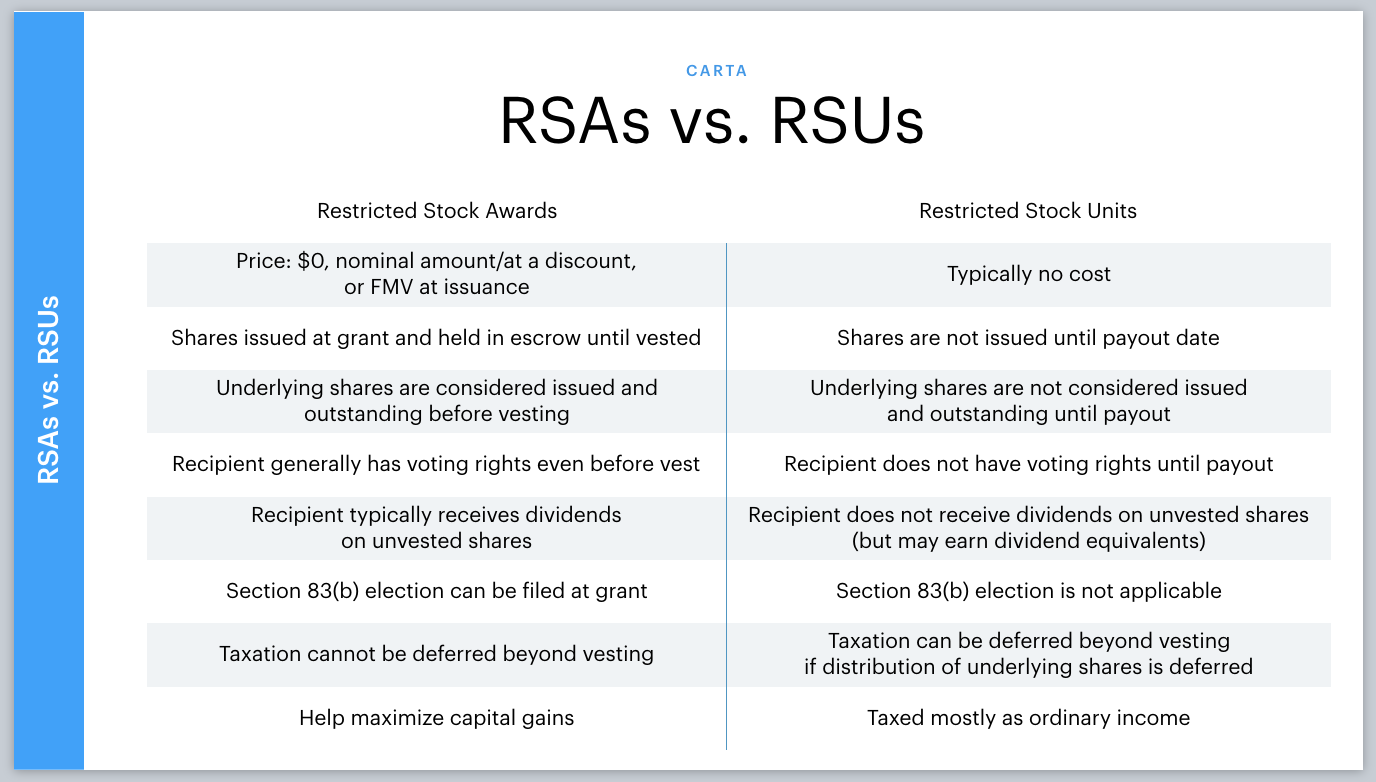

This is different from incentive stock options which are taxed at the capital gains rate and tax liability is triggered when the options are exercised. Robinhood listed at 38. If you live in a state where you need to pay state income taxes repeat steps 2 and 3 using your state marginal tax rate.

On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers. Rather it is categorized as a deferred compensation. A app to help calculate how much tax you pay on RSUs A app to help calculate how much tax you pay on RSUs.

Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained. Carol Nachbaur March 24 2022. Compare how the total payout may change between options and RSUs.

Thus the RSU above attracts tax two times. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. It too offered its employees the choice between 22 and 37 withholding on their RSUs vesting on Day 1.

When the RSU vest with the employee he need to include it in his salary income as perquisite and pay tax on same. When it comes to RSUs there is no mark-to-market tax implication.

Rsu Taxes Explained 4 Tax Strategies For 2022

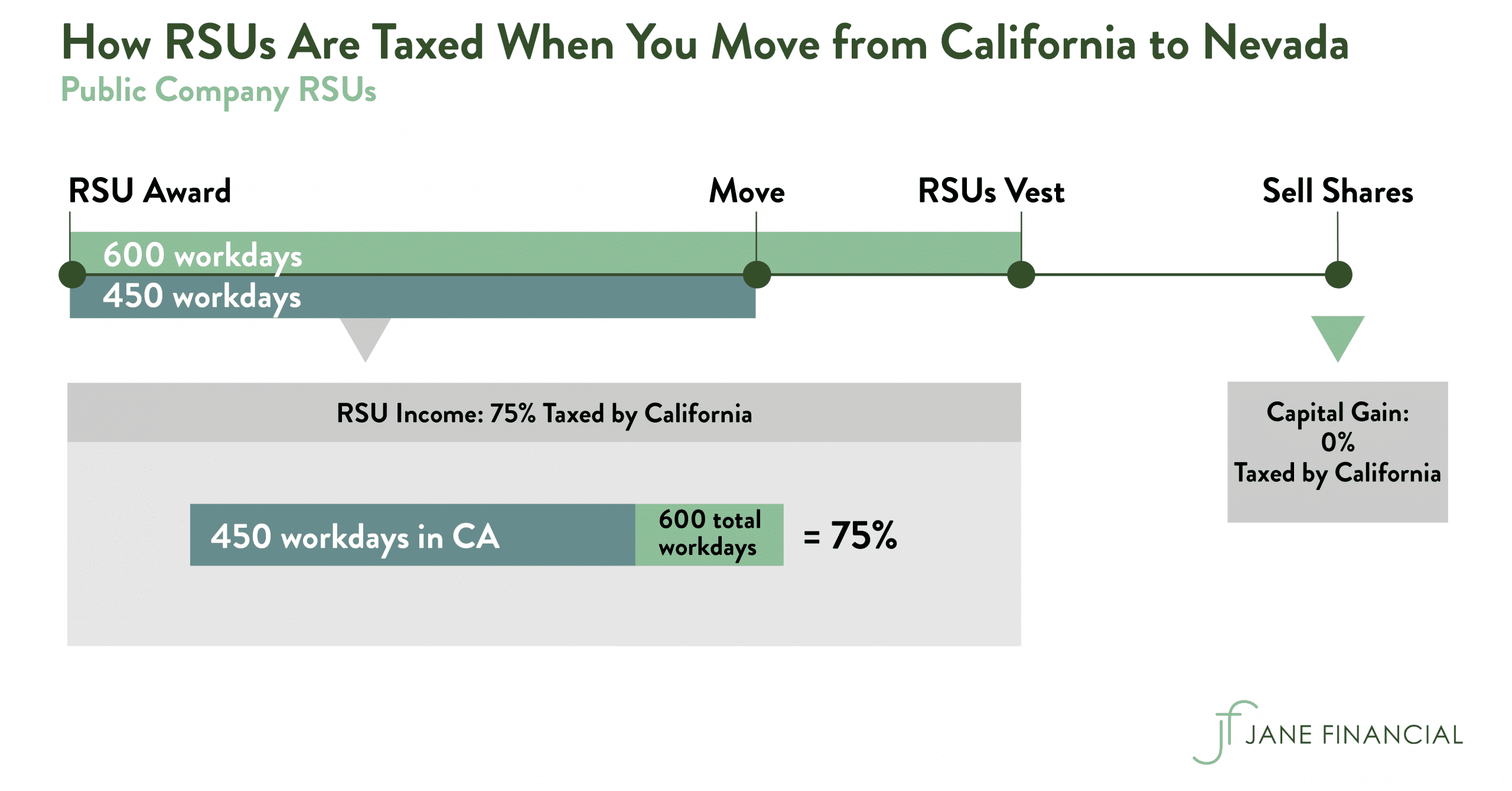

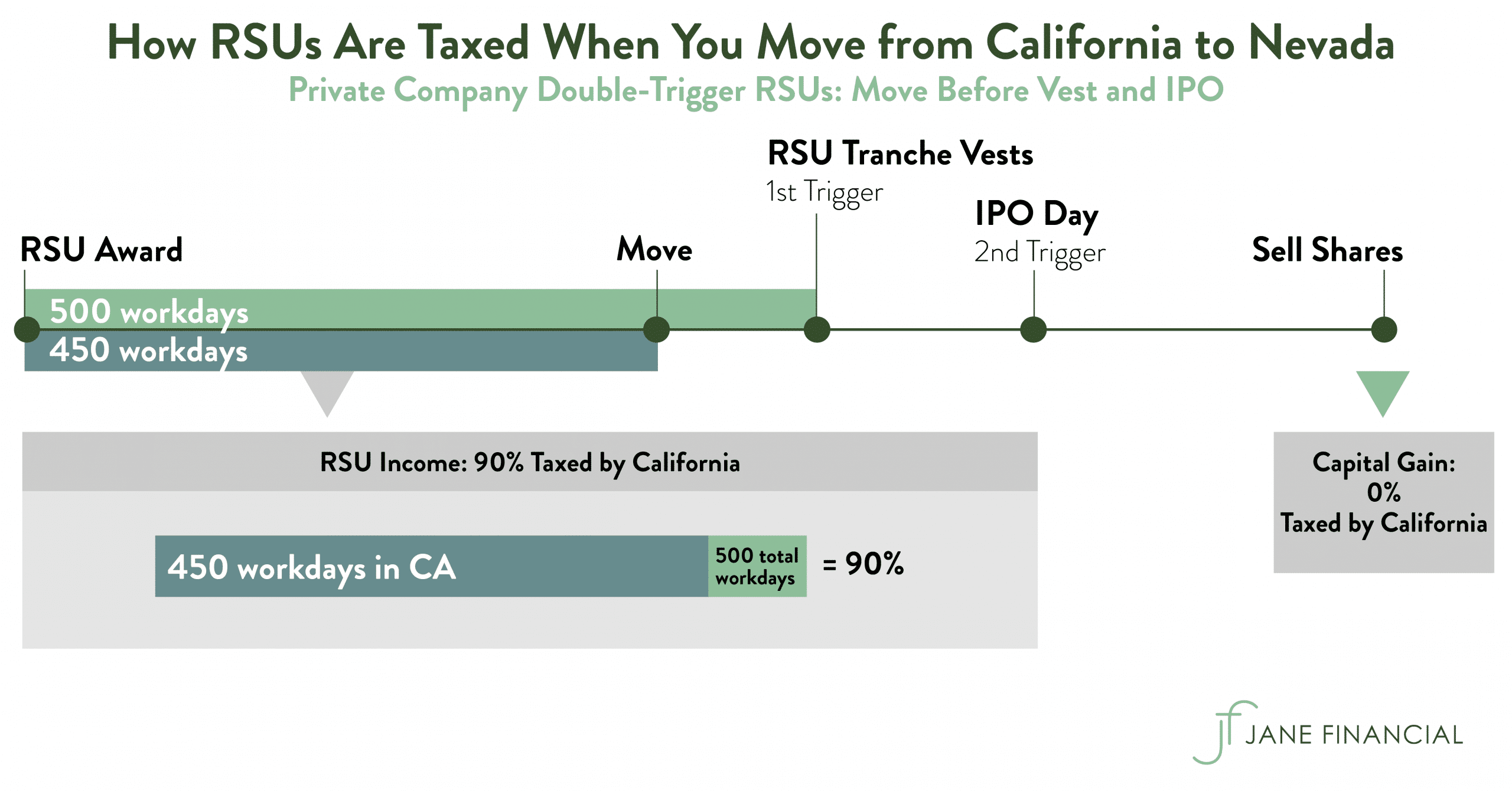

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

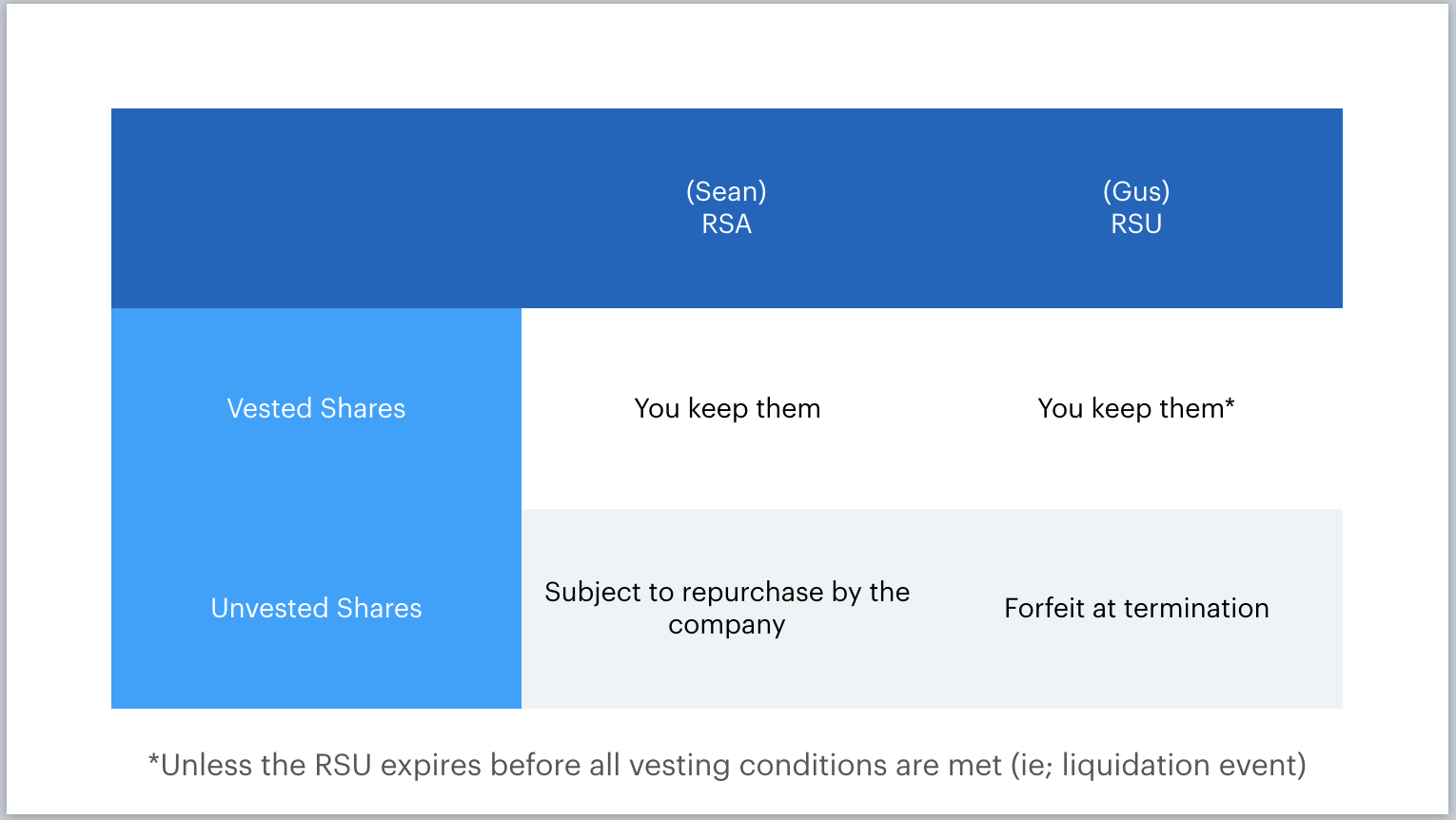

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units Jane Financial

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

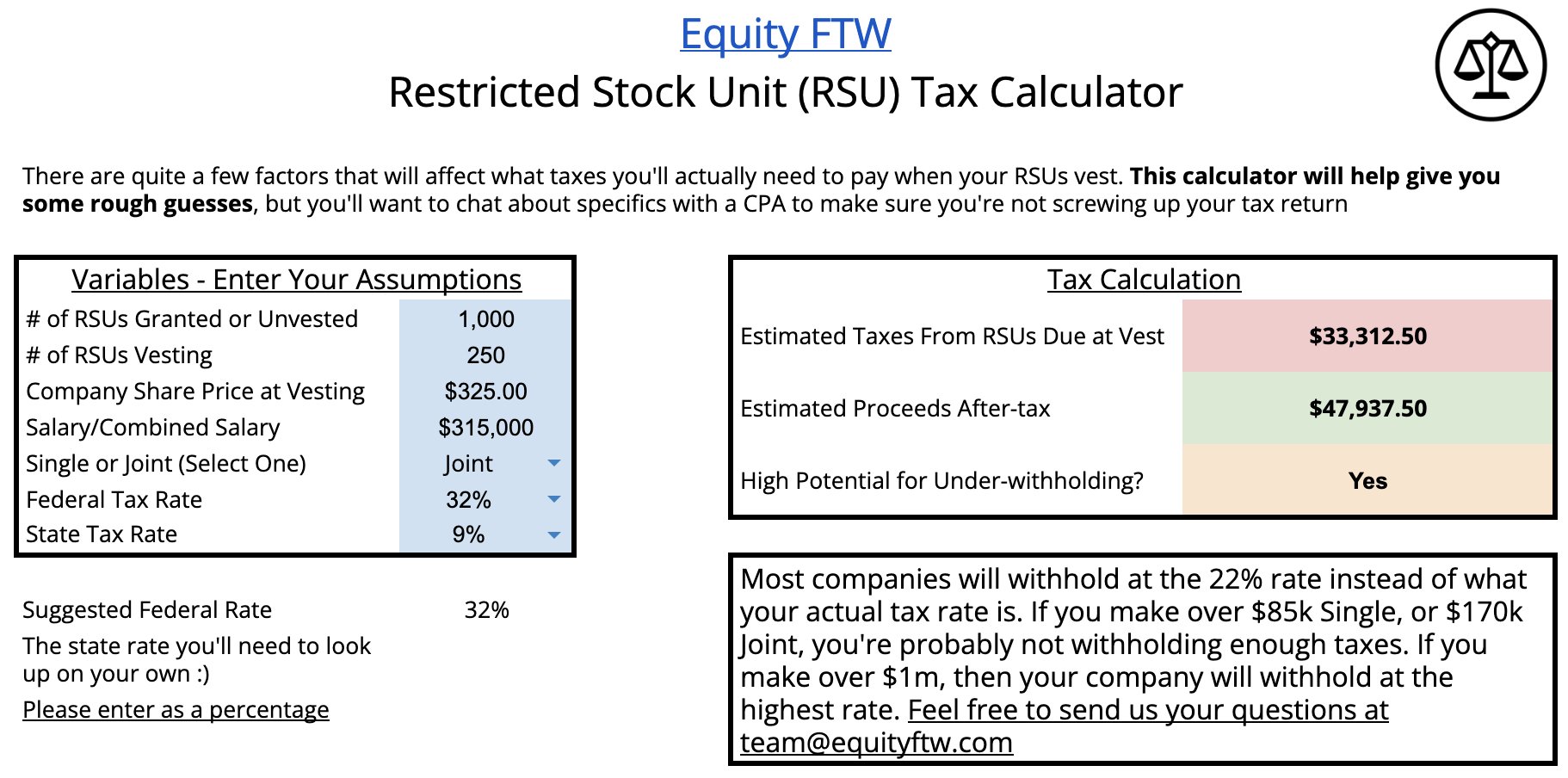

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Rsus Restricted Stock Units Essential Facts Capital Gains Tax Key Dates How To Apply

Rsu Taxes Explained 4 Tax Strategies For 2022

Taxation Of Restricted Stock Units Vested Stock Options Vs Rsu S

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

/GettyImages-655242786-038f5688f69840899bc4f35415351106.jpg)

How Restricted Stock Restricted Stock Units Rsus Are Taxed

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta